Helping financial service providers navigate workforce transformation

Technology, including AI and automation, could replace one in four banking jobs in the next 5 years. As these changes occur, banking and finance leaders need actionable data and insights to reshape their workforce, meet new demands, and succeed in a dynamic market.

Use data to reskill workers and boost engagement

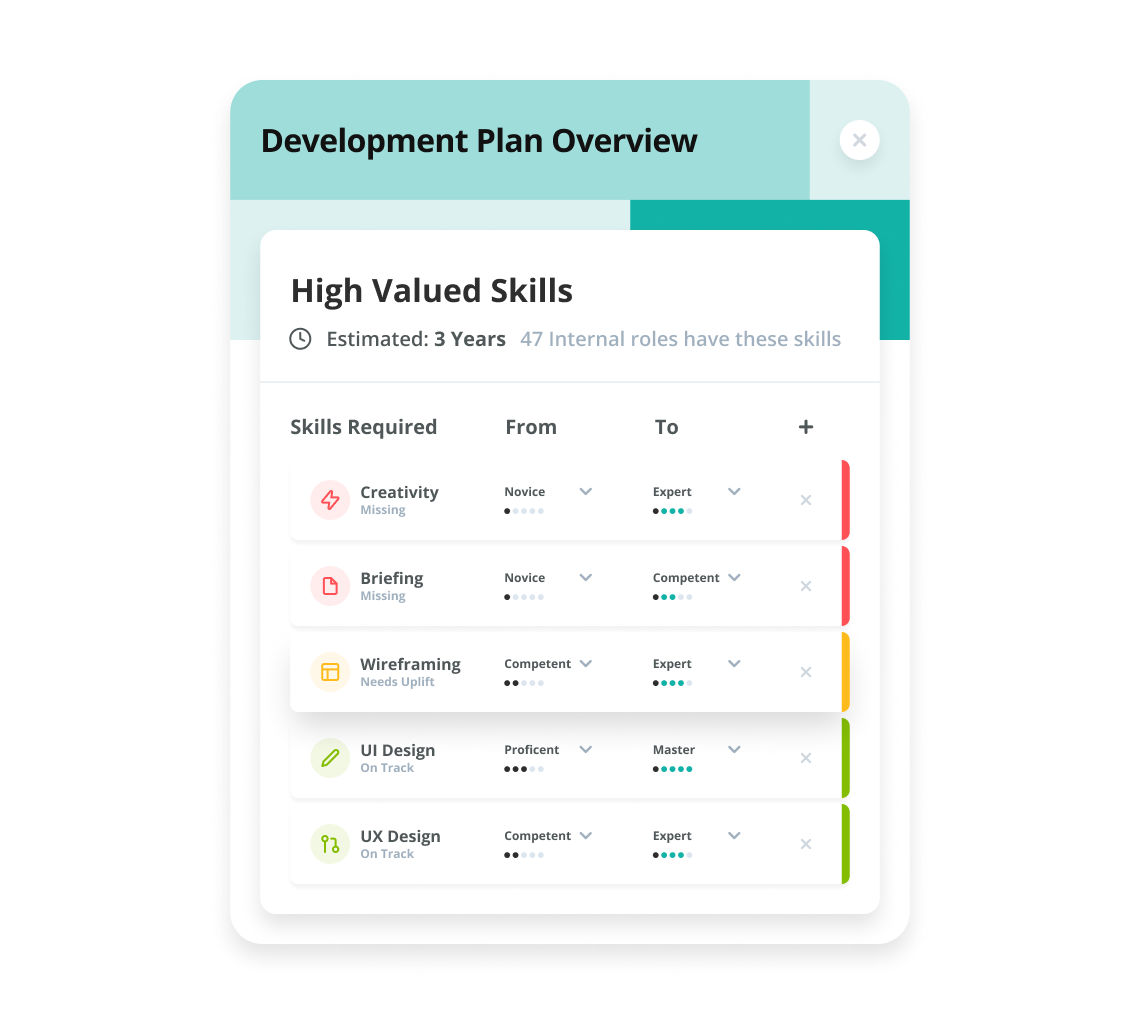

The pace of change in banking in the next five years will require employees to learn new skills and deepen their expertise in some existing skills. Collaboration, personal learning and mastery, achievement focus and agility will be critical for everyone working in financial services.

Normalized data on jobs and skills allows leaders to identify shortcomings in critical workforce capabilities and then plan L&D programs to build and strengthen strategic skills.

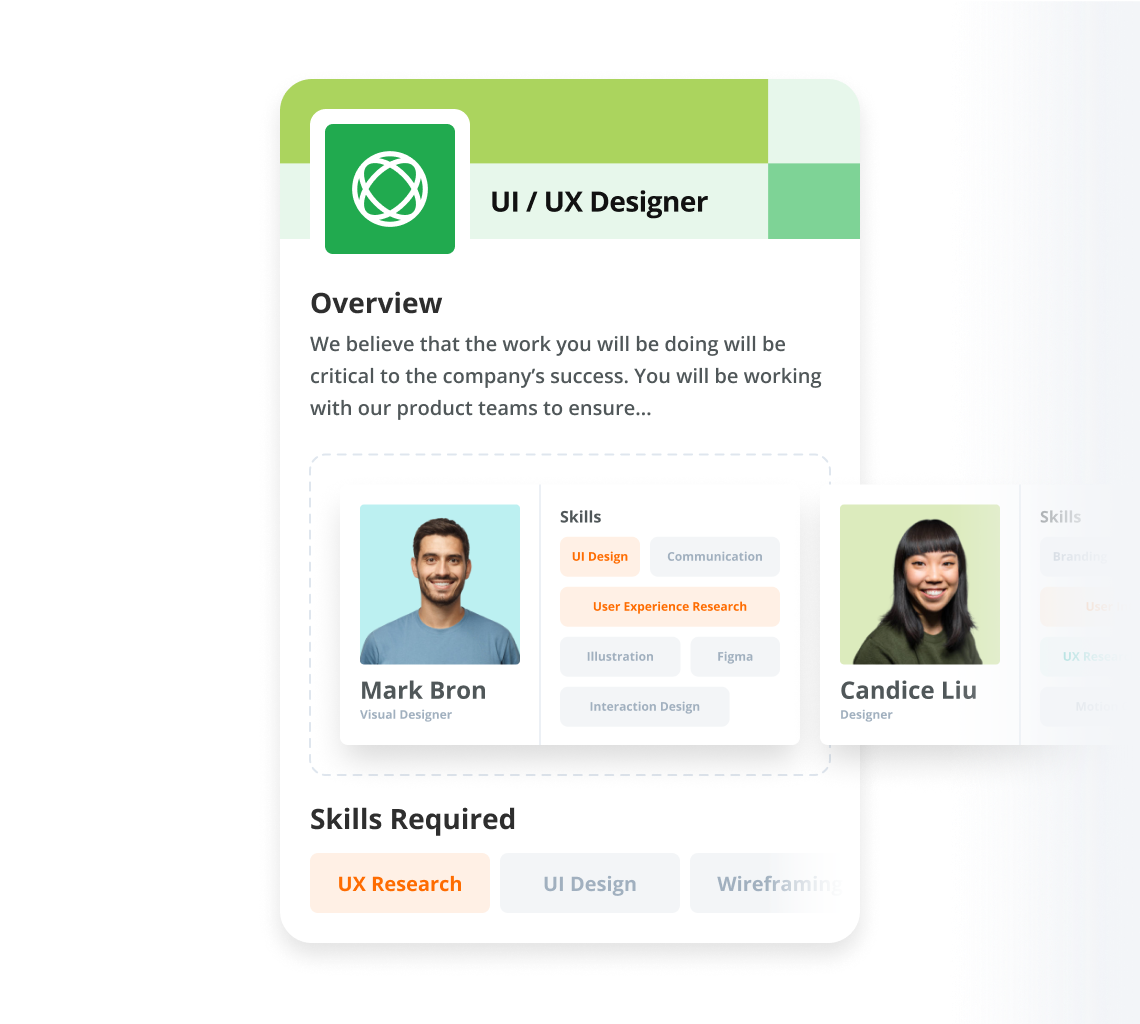

Grow into new services and deepen customer engagement

Banks are increasingly supporting more than just customer transactions. They are seeking to provide holistic business and personal financial services, including investment management, insurance, business services and more.

Understanding skill requirements for new services and the skill gaps you need to bridge can guide you in building a talent strategy that supports your organization’s business plan. This talent strategy can include training initiatives and skills-based assessments during the hiring process.

Be confident in your employees’ skills

Credly by Pearson’s digital credentials provide third-party verification and a granular, skills-based understanding of what your employees and potential new hires can do. This ensures, for example, that someone in an anti-money laundering role has specific skills related to OFAC regulations, due diligence investigations and related tasks.

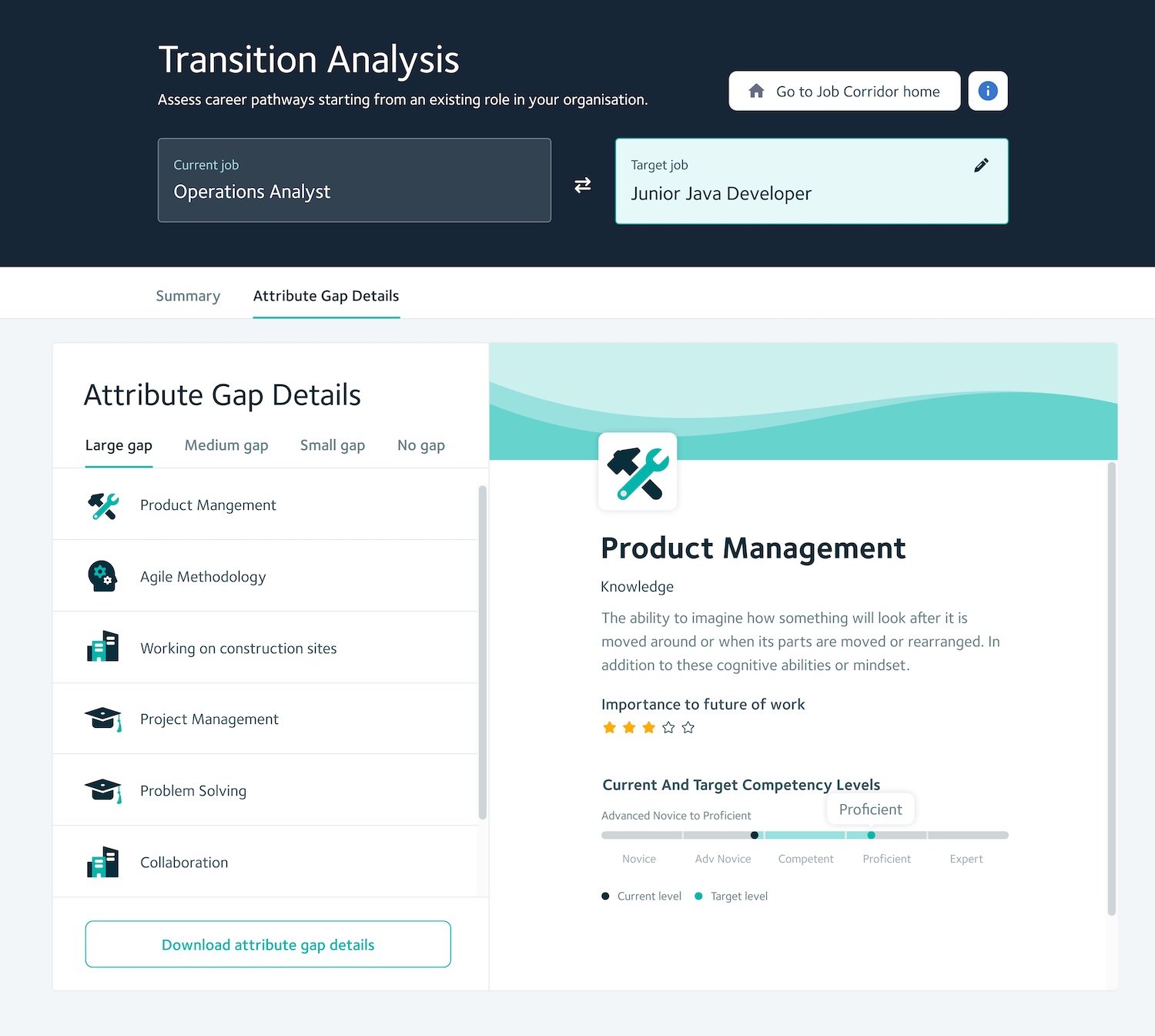

Know what skills will be required in the future

As the financial services industry changes, understanding what new skills will be required — and what existing skills must be retained and strengthened — will be critical for a winning business strategy. As technology transforms banking, technical experts who can boost financial performance will be critical.

a secure suite of workforce solutions

Tap reliable technology for workforce transformation

Because financial services are highly regulated and a critical part of the economy, cybersecurity and resilience are critical. Credly by Pearson’s integrated and secure suite of workforce solutions gives you the tools to future-proof your financial services workforce.

The industry-leading Acclaim platform provides employees and employers verified digital credentials, while Workforce enables leadership to see what skills employees have and what skills they’ll need.

Faethm data services can help you understand where the finance industry is headed, how to plan your organization to stay competitive, and gives you the tools to create learning pathways to bridge the gap between your current and future workforce. Paired with Pearson TalentLens to help you accurately assess job candidates against job requirements and better predict employee performance, you have a powerful workforce planning solution.

You can also leverage world-class Professional Services to help you define your approach, develop success metrics and scale digital credential initiatives, while also assisting with job analysis, credential-to-learning path evaluations and change management plans.

Enterprise-class hosting and disaster recovery ensure your data remains safe and secure, allowing you to focus on building the banking and finance workforce of the future. Integrations with other commonly used HR and learning platforms make it easy to add Credly by Pearson’s products to existing systems.

Trusted By World-Class Organizations

"When we make data-driven decisions on skills data, it allows us to deepen our talent pools for in-demand, short-supply rules that unlock this zero barrier to internal talent mobility"

/Webinar_What%20Skills%20Will%20Define%20The%20Future%20of%20Banking_Email.png?width=2000&name=Webinar_What%20Skills%20Will%20Define%20The%20Future%20of%20Banking_Email.png)

/Webinar%20Thumbnail_Banking.png?width=1920&height=1080&name=Webinar%20Thumbnail_Banking.png)