Skills management for the future of the insurance industry

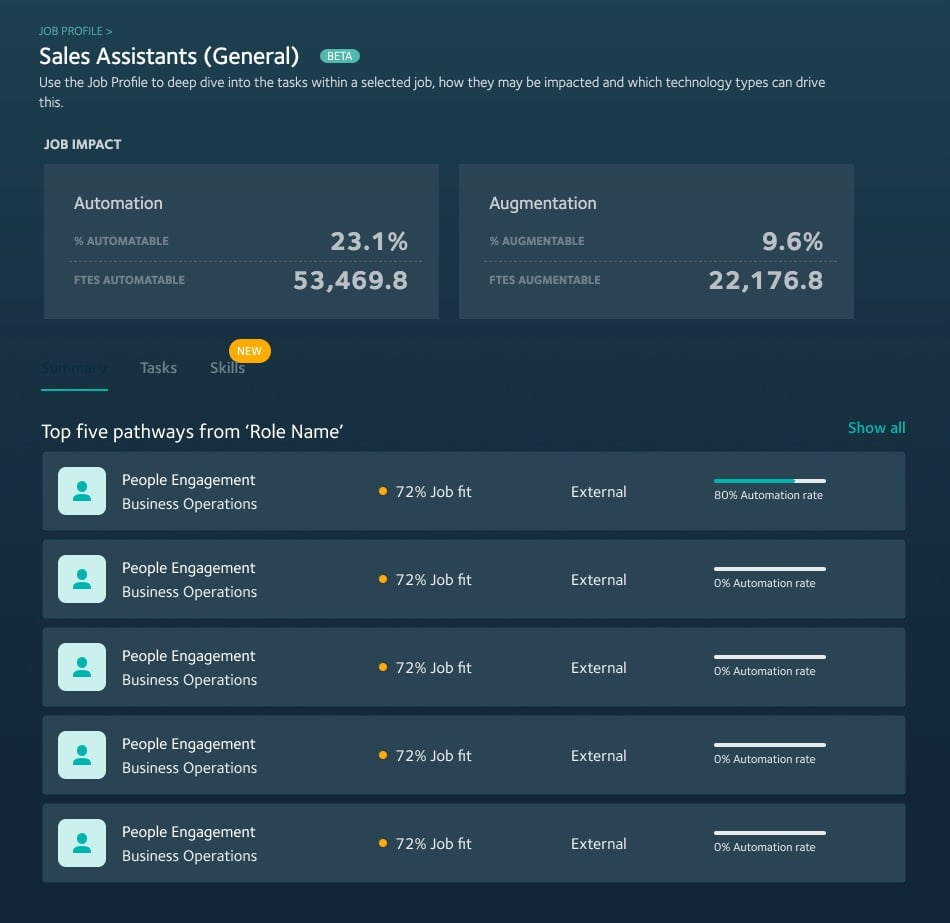

Technology and automation could replace 26% of insurance industry jobs by 2028. Boost your company’s technology skills while also strengthening employee power skills to remain competitive.

Know the critical power skills for the insurance industry

Leadership, customer service and related power skills will become even more important as the industry shifts. Digital transformation requires more technical expertise, but insurance industry success will still rely on people with a strong focus on customers, ability to collaborate and an achievement focus.

Gain accurate information about employee skills

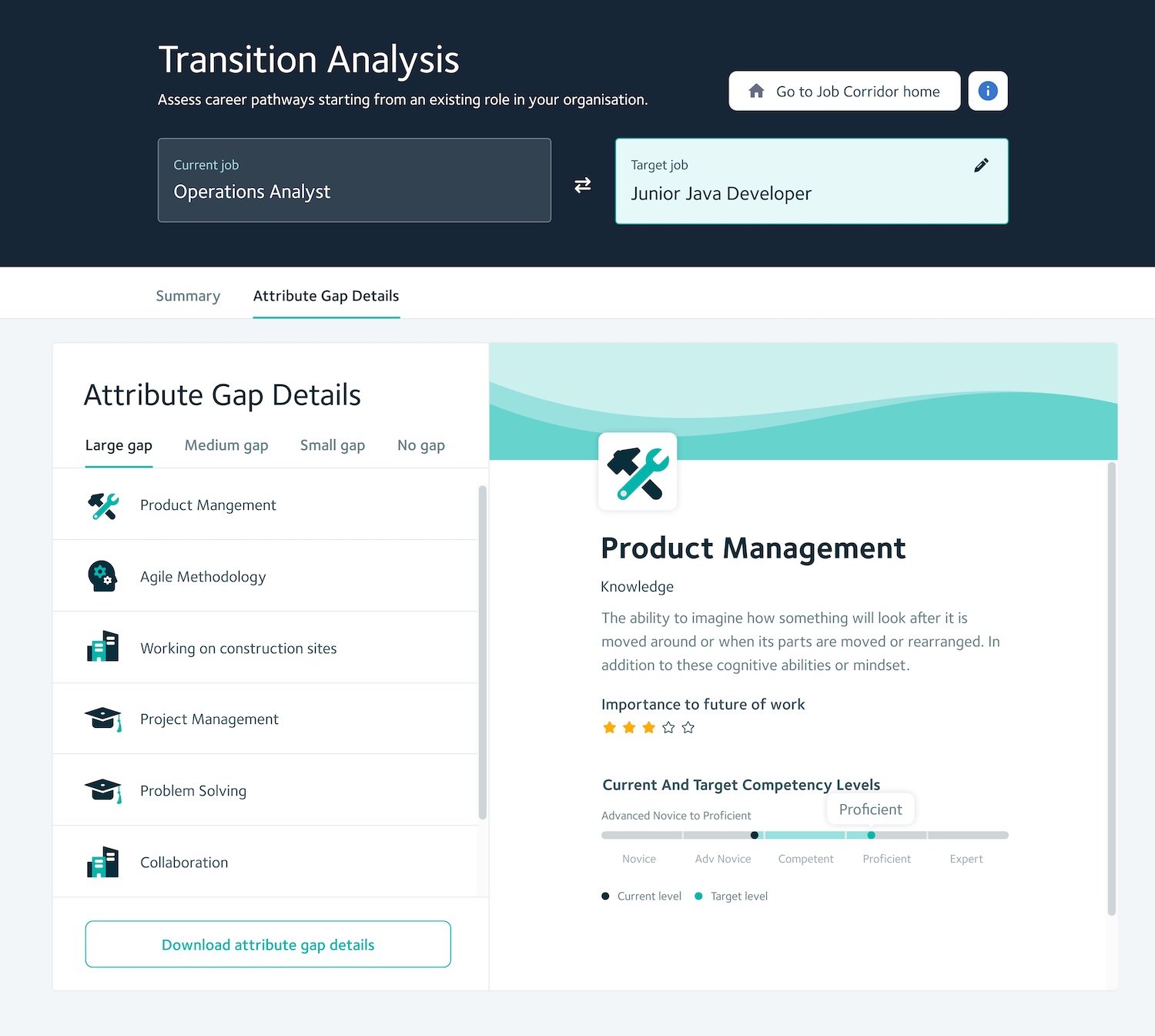

As the insurance industry digitizes, new roles with technology skills in enterprise technology platforms and informatics, will be required. Knowing what skills your talent pool already has can help you identify pockets of hidden strength and pinpoint critical technology skill gaps.

See skills trends for better planning

Industry trends indicate that in the next five years, insurance companies will require more software application developers, information security analysts, business analysts and other digital roles. Knowing exactly what new skills you’ll need in your workforce helps you develop a more competitive talent strategy.

-2.png?width=969&height=927&name=MicrosoftTeams-image%20(3)-2.png)

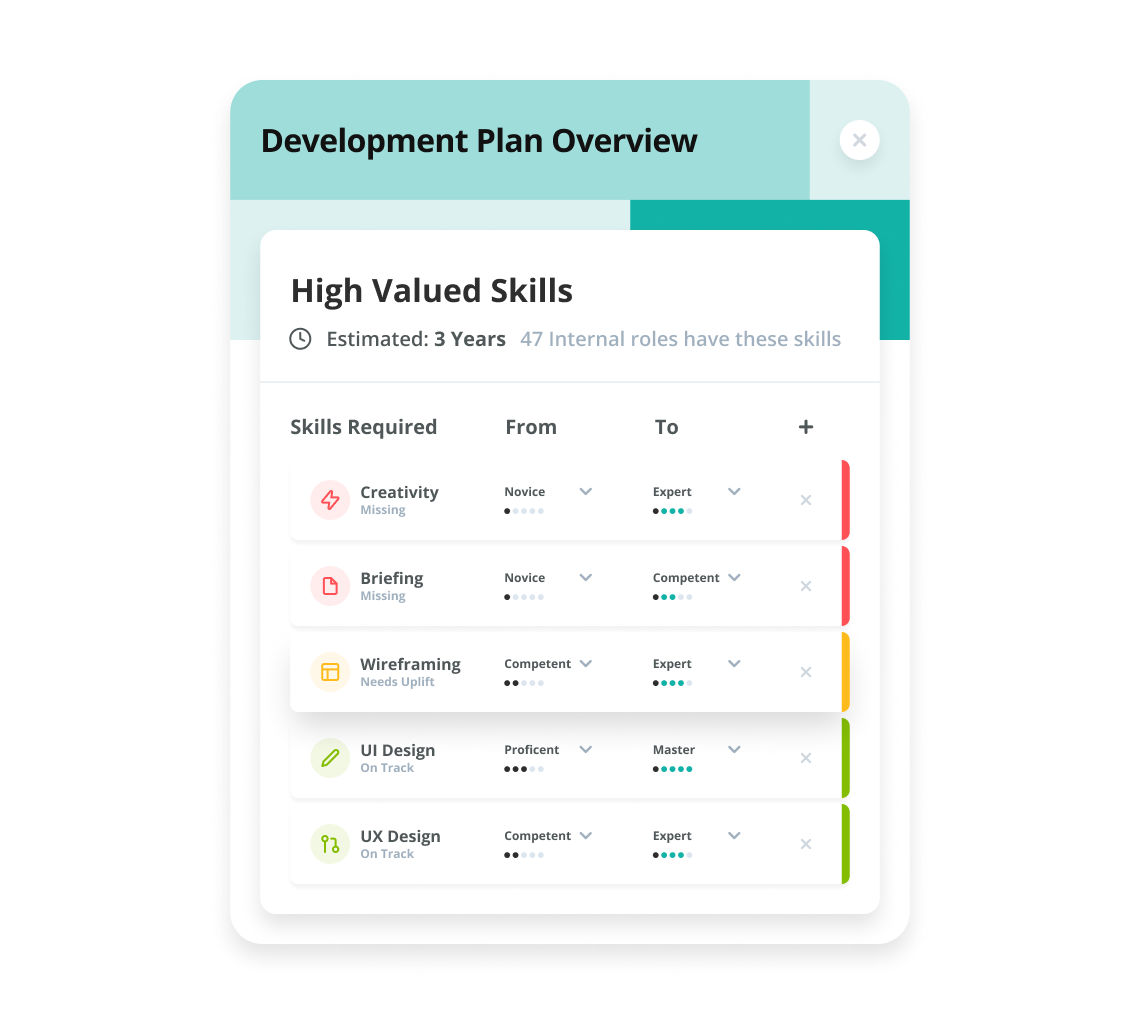

Lower workforce risk through upskilling and reskilling

Creating paths for employees to upskill and reskill can help you retain workers, increase engagement and meet your changing skills needs. Skill-demand trends in insurance show a dual focus on enhancing customer experiences and improving organizational performance. This means your workforce needs both high-touch and high-tech skills.

a secure suite of workforce solutions

Tap reliable technology for workforce transformation

Because insurance is highly regulated and a critical part of the economy, cybersecurity and resilience are critical. Credly by Pearson’s integrated and secure suite of workforce solutions gives you the tools to future-proof your financial services workforce.

The industry-leading Acclaim platform provides employees and employers verified digital credentials, while Workforce enables leadership to see what skills employees have and what skills they’ll need.

Faethm data services can help you understand where the insurance industry is headed, how to plan your organization to stay competitive, and gives you the tools to create learning pathways to bridge the gap between your current and future workforce. Paired with Pearson TalentLens to help you accurately assess job candidates against job requirements and better predict employee performance, you have a powerful workforce planning solution.

You can also leverage world-class Professional Services to help you define your approach, develop success metrics and scale digital credential initiatives, while also assisting with job analysis, credential-to-learning path evaluations and change management plans.

Enterprise-class hosting and disaster recovery ensure your data remains safe and secure, allowing you to focus on building the insurance workforce of the future. Integrations with other commonly used HR and learning platforms make it easy to add Credly by Pearson’s products to existing systems.

Trusted By World-Class Organizations

"Whilst we can't ignore the benefits that automation brings, it's important to retain, nurture and educate our teams. It's crucial that we factor the future skills requirements for the business into the process now. If we know what's coming, we can start transitioning existing employees into new careers today."

.jpg?width=2000&height=762&name=three-managers-discussing-their-ideas-by-table-2021-09-24-03-45-39-utc-(1).jpg)